The Origin of “A Fool And His Money Are Soon Parted”

This phrase is at least 460 years old. It was used by a poet named Thomas Tusser in a poem he wrote called Five Hundred Points of Good Husbandry, in the year 1557. While the wording is a bit different, the expression is still similar enough to the one that’s used today:

“A fool and his money be soon at debate: which after with sorrow repents him too late.”

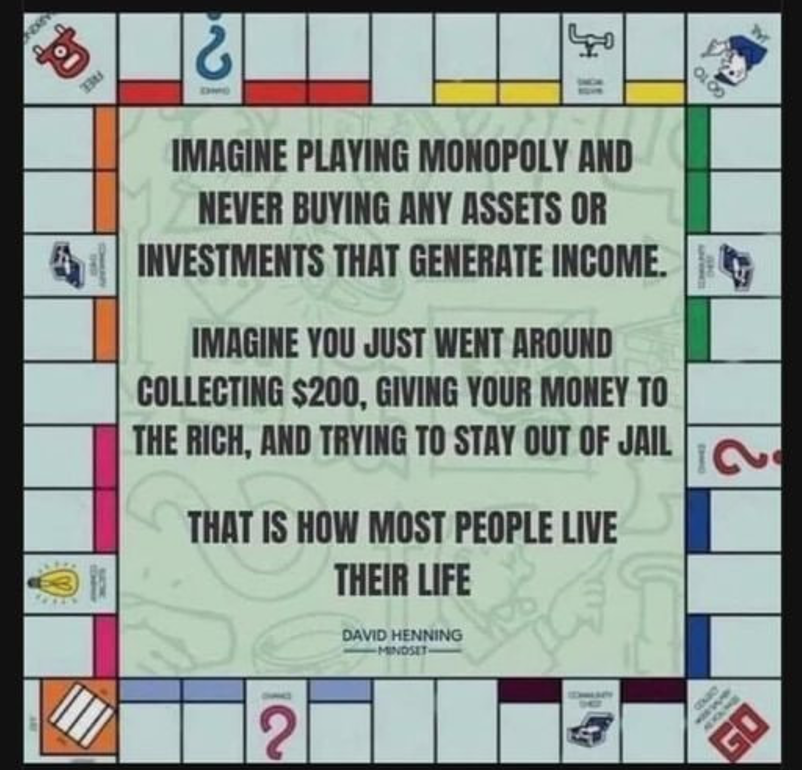

What is the idea behind this saying, for those who may not know? Basically, it means that a person who acts carelessly with their money will lose it fast. For example, if someone is careful with their money and primarily spends it only on necessary things—food, water, clothes, etc.—then their money will likely last them a while.

However, if a person is reckless with how they use their money and they do something like say, gamble it away at a casino, then their money will likely not last long at all. Indeed, they would be “parted” or “separated” from their money in no time!

Thus, when someone acts carelessly with their money and loses it as a result, then as the saying goes, a fool and his/her money are soon parted.

Examples of Foolish Behavior

Governments and financial institutions are great institutions that can easily make you poorer.

Governments have legal (ponzi) schemes in the form of lottery (scratch cards, lottery plays twice a week). I knew a construction worker who spent 25 euro each month from his salary on WIN FOR LIFE scratch cards. He’s still trying.

Financial institutions are another great example of a profitable business model that discounts the wealth of people. This happens in the form of banking fees or charges for banking services. If you have no or limited financial literacy, you are definitely a fool and an easy victim to be separated from your money.

Strategic approach

If you want to invest in your financial literacy competences, define first your objectives. Investing blindly in trading or investing courses won’t bring you any step closer. In most cases you won’t do anything with the knowledge.

Personally I believe basic knowledge can easily be found online for free. In electronic books or youtube videos. Another solution is to join a Free Facebook or Reddit/Discord group. Whether it’s index investing or any other skill, learn some basics first about the pros and cons.

If you want to invest in yourself to take your trading or invest skills to a higher level, work closely with a mentor. Each mentor that I paid in the past, contributed to the financial skills where I am today. Every year I continue to invest in my knowledge.

I read that you shouldn’t pay big bucks for a course from a trading/investing guru. What’s big bucks ? That’s very personal. The highest investment I made in myself was 34.000 euro for my Execute MBA out of my own pocket. I paid for courses that were definitely not worth their price and I paid ‘little’ money for mentors that worked at large hedge funds. They were worth every penny.

I don’t believe in paying for courses that don’t serve a purpose in your personal finance strategy. Why do you go to a crypto course if you will never invest or trade in crypto ? Especially when the course is given by a private banker. Personally we don’t believe in selling courses as there’s no way you can capture everything in a course. When people start executing, the biggest value comes as then the questions start to pop up. I strongly believe in mistake based learning. Some people learn visually, some people learn by memorizing and practicing.

So don’t be a fool buying blindly courses from anyone. Assess your goals and purpose and then make a decision whether this is a correct investment for your progress.

Your accountability

Whether you want to learn about stocks, real estate, trading, dropshipping or any other skill, invest in your knowledge. Even after following a mentorship program or a course, it’s your responsibility to take action. Don’t expect immediate results. Every course needs to lead to a change of mindset and behavior. If not, you simply wasted your money and you are the biggest fool.

It’s your money and your responsibility. The same principle applies when you join the 5% Club.